Coating & Ink

In recent years, the coating and ink industry in Vietnam has experienced significant growth, driven by rapid industrialization and urbanization.

OVERVIEW VIETNAM COATINGS MARKET

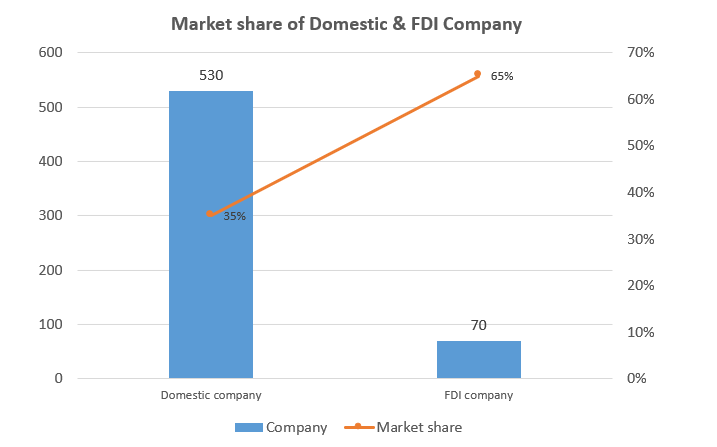

There are about 600 enterprises operating in Vietnam’s paint and coating industry, 70 of which are foreign-invested companies. According to a report by VPIA (Vietnam Paint and Ink Association), in the past 5 years, paint manufactured by FDI company has accounted for more than 65% of the Vietnamese market despite their small quantity, while that of domestic companies accounted for only 35% of market share.

Market segment and their value in the VN paint

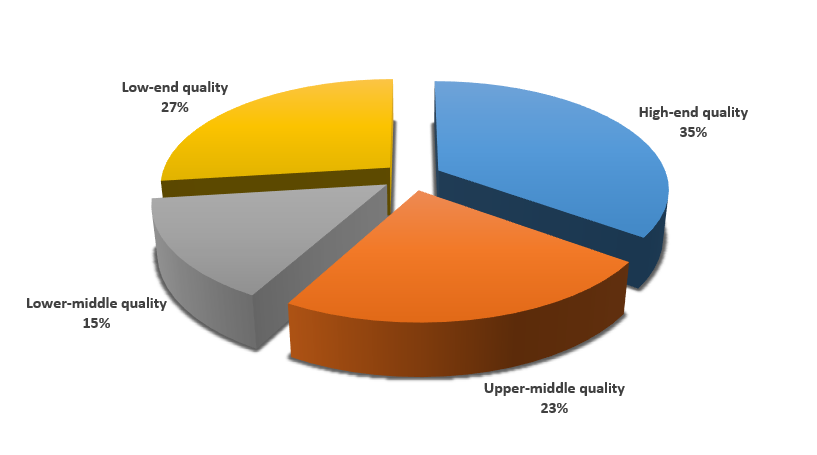

The Vietnamese market can be classified into four distinct groups. High-end segment, upper-middle segment, lower-middle segment and low-end or mass segment, High-end paint in architectural and industrial segment account for nearly 35% of the total Vietnamese coatings market on value basis. Upper-middle and lower-middle segments account for 23% and 15% of the market share. The low-end segment accounts for the remainder 27% of the total market (2022)

Consumption of Vietnam Coatings from 2019-2030

Vietnam Paints and Coatings Market – Industry Trends & Forecast Report, 2030

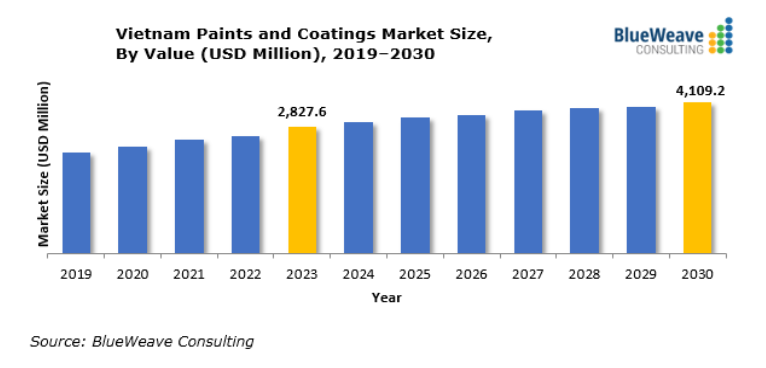

Vietnam Paints and Coatings Market size by value was estimated at USD 2,827.6 million in 2023. During the forecast period between 2024 and 2030, Vietnam Paints and Coatings Market size is expected to expand at a CAGR of 5.60% reaching a value of USD 4,109.2 million by 2030. Major factors driving the growth of Vietnam Paints and Coatings Market include increasing construction activities, both residential and commercial, fueling demand for architectural coatings. Industrialization and infrastructure development also contribute significantly, boosting the need for protective and industrial coatings. Moreover, rising disposable incomes and urbanization drive consumer preference for decorative and automotive coatings. Environmental regulations promoting eco-friendly and low-VOC coatings further influence market dynamics, emphasizing sustainability and health concerns.

Coatings Industry Structure by Volume in 2023

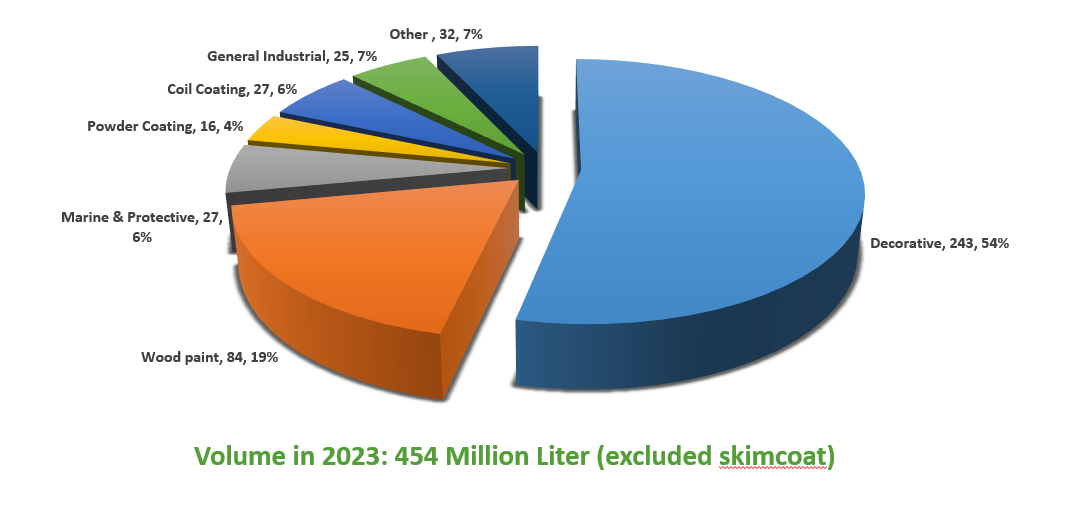

The Vietnamese coating industry has six large and small segments. Mainly in the decorative segment, it accounts for nearly 53% of the total volume of Vietnamese coatings and Wood paint accounts for 18%.

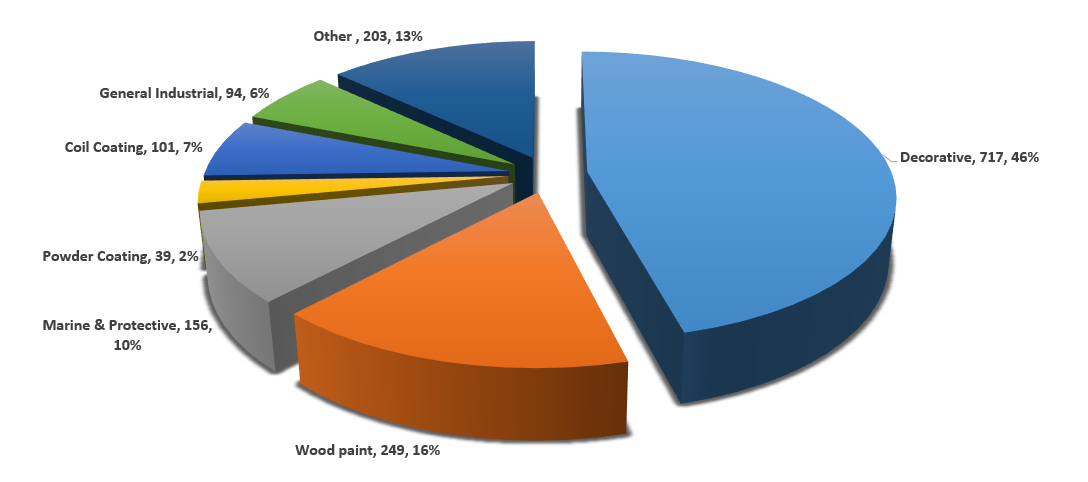

Coatings Industry Structure by Revenue in 2023

Although decorative paint accounts for 53% of output but only 46% of revenue, wood paint accounts for 18% of output but only 16% of revenue, and powder coating accounts for 4% of output but only 2% of revenue. Meanwhile, marine and protective paint account for only 6% of output but 10% of total revenue, and coil paint accounts for 6% of output but 7% of revenue.

Market Trend

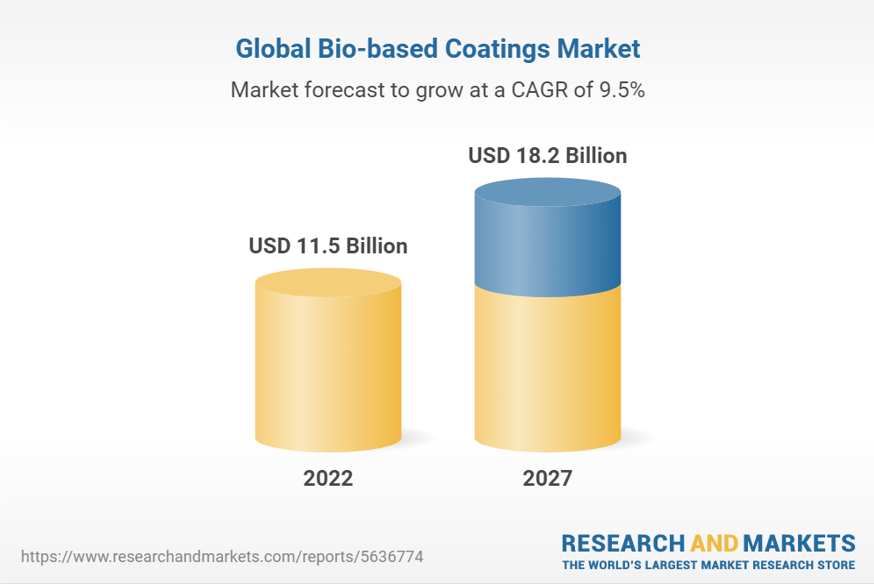

The bio-based coatings market is projected to grow from USD 11.5 billion in 2022 to USD 18.2 billion by 2027, at a CAGR of 9.5% between 2022 and 2027.