COSMETICS

Vietnam’s cosmetics market is growing fast, driven by a young population, rising beauty awareness, and increasing demand for quality personal care products. Local consumers are open to global trends, natural ingredients, and innovative formulas, making Vietnam a promising destination for cosmetic brands and suppliers.

Vietnam Cosmetics & Personal Care Market 2025

Expert Insight from an Additives & Ingredient Supplier Perspective

I. Market Size & Growth (Verified)

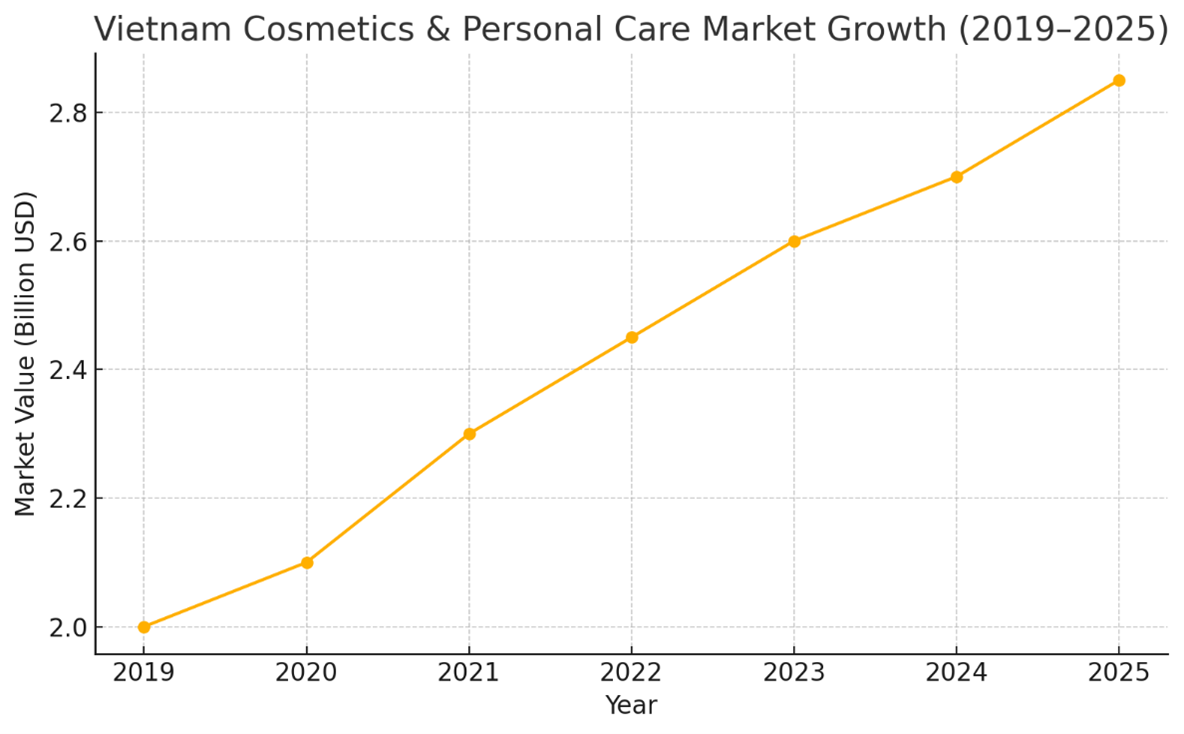

- Vietnam’s beauty & personal care market is projected to reach US$2.75–3.0 billion in 2025 (Statista, 2023), up from US$2.3 billion in 2021.

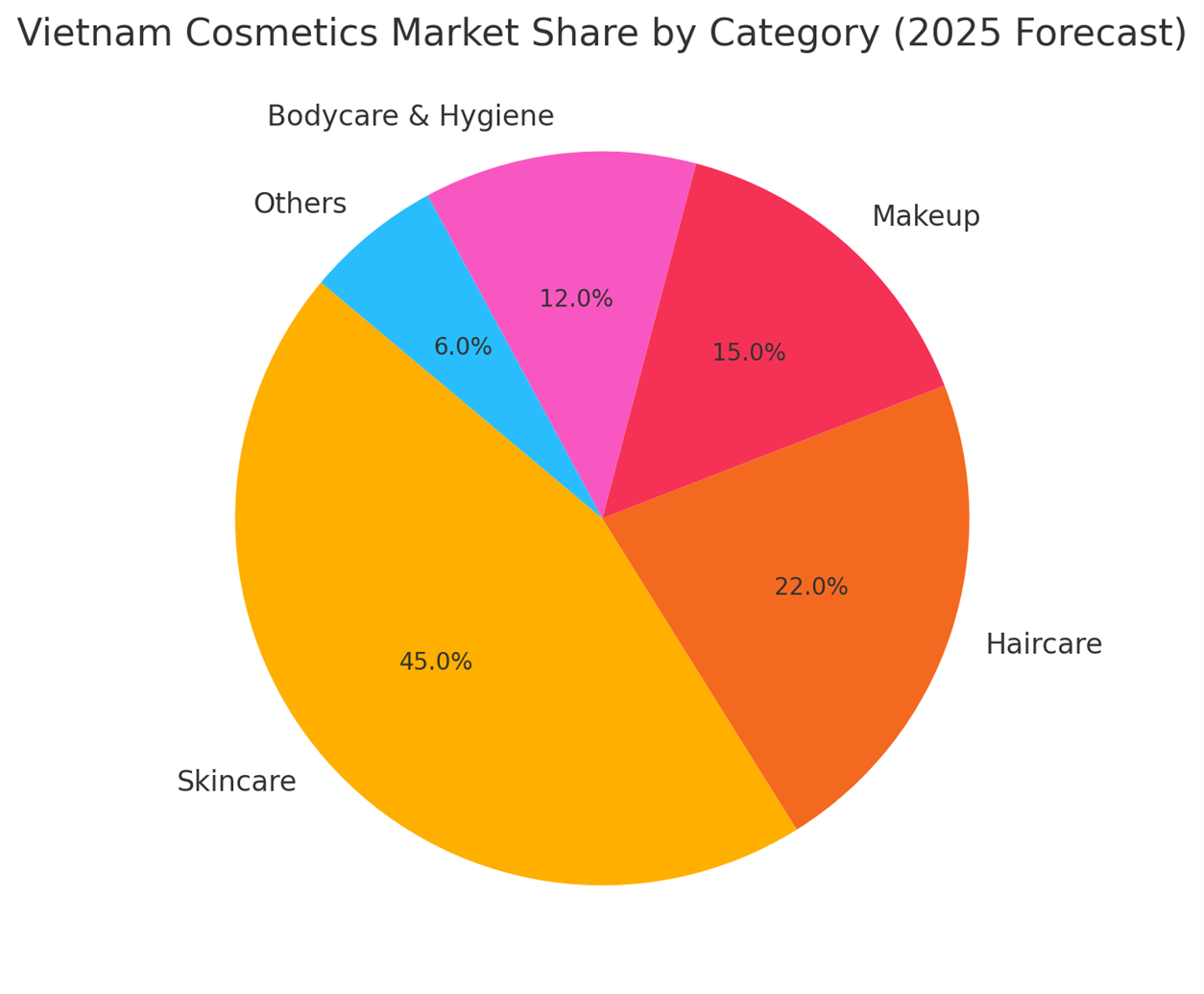

- CAGR 2021–2025: ~5.9%, with skincare remaining the leading category, followed by haircare and color cosmetics.

- Local production is expanding to meet demand for private labels and clean beauty, with support from modernized factories, OEM/ODM partners, and local ingredient sourcing.

Sources:

- Statista.com, Vietnam Beauty & Personal Care Market Forecast (2023)

- Vietnam Briefing, Vietnam’s Emerging Cosmetics Industry (2022)

- Euromonitor, Vietnam Beauty and Personal Care Report 2024

II. Consumer Shift: From Price-Driven to Ingredient-Conscious

Vietnamese consumers, especially Gen Z and Millennials, are shifting from purely price-based decisions to being increasingly informed about ingredients, safety, and environmental impact.

| Consumer Demand | Ingredient Opportunity |

|---|---|

| Clean & Natural | Preservative-free systems, natural emulsifiers, plant oils |

| Sensitive Skin | Ectoin, ceramides, allantoin, panthenol, microbiome-friendly agents |

| Skin Brightening | Glutathione, niacinamide, licorice extract, vitamin C derivatives |

| Anti-Aging | Bakuchiol, retinoid alternatives, peptides, fermented actives |

| Multifunctional Skincare | Hybrid active blends (moisture + anti-pollution + soothing) |

| Local Ingredients | Vietnamese turmeric, green tea, centella, coffee seed extract |

Insight: Formulators are demanding clinically backed, marketing-friendly ingredients that meet global standards such as ISO 16128, COSMOS, or ECOCERT.

III. Manufacturing Expansion & Local Demand for Ingredients

- OEM/ODM manufacturers in HCMC, Bình Dương, Đồng Nai, and Bắc Ninh are increasing output to supply:

- Emerging local brands (e.g., Cocoon, Skinna)

- Foreign buyers seeking ASEAN-based production

- Cross-border e-commerce brands

- They are looking for stable additive supply, formulation support, and smaller MOQ options for pilot launches.

- Notable manufacturers: Thorakao, Saigon Cosmetic, Sao Thái Dương, I.C.E Vietnam, ResHPCosmetics

IV. 2025 Trends Creating Additive Demand

| Trend | Supplier Opportunity |

|---|---|

| Fermentation + Biotech Skincare | Yeast filtrates, fermented mushroom extract, postbiotics |

| "Skinimalism" | Fewer products, high-potency actives |

| Anti-Pollution Care | Film-forming polymers, antioxidants, chelating agents |

| Baby & Men’s Care | Allergen-free systems, ultra-mild surfactants, fragrance modulators |

| Local Storytelling | Ingredient origin from Vietnam supports “farm-to-face” positioning |

Formulation note: High interest in eco-friendly rheology modifiers, cold-process emulsifiers, and sensorial enhancers to align with TikTok-driven and eCommerce-friendly beauty formats.

V. Challenges for Raw Material Suppliers

| Challenge | Mitigation Strategy |

|---|---|

| Regulatory complexity (MOH, DAV) | Support clients with CFS, INCI declarations, MSDS/TDS in Vietnamese |

| Limited technical capacity among small brands | Offer formulation guides, sample kits, lab-scale support |

| Small batch production demands | Enable flexible MOQ and supply lead time transparency |

| Price vs performance tension | Provide benchmark studies showing cost-in-use benefits |

VI. Strategic Role for Additive Suppliers in 2025

- Offer ready-to-use formulation concepts aligned with market trends

- Provide claim substantiation, clinical data, and test results

- Educate local formulators via webinars, samples, and co-development

- Support documentation for compliance & MOH approval

- Highlight sourcing sustainability and traceability

Conclusion

Vietnam’s beauty industry is no longer a price-driven, passive import market. It is a strategic regional hub for innovation, clean beauty, and conscious consumers. Ingredient and additive suppliers who combine technical depth, agile logistics, and market insight will define the next wave of successful brands in Vietnam.

Key References

- Statista – Vietnam Beauty & Personal Care Market Outlook 2025

- Vietnam Briefing – Vietnam’s Emerging Cosmetics Industry: vietnam-briefing.com

- VIRAC Report Q2/2022 – Cosmetics & Personal Care Vietnam

- Euromonitor International – Beauty and Personal Care in Vietnam 2024

- Innovative Hub Vietnam – Industry Trends & Ingredient Focus in 2023

- Vietnam Ministry of Health (DAV) – dav.gov.vn