PVC

The Vietnam PVC market is experiencing steady growth driven by rapid urbanization, infrastructure development, and manufacturing growth. The construction industry is a significant consumer of PVC, particularly for pipes, fittings, and profiles...

VIETNAM POLYVINYL CHLORIDE MARKET

The Vietnam PVC market is experiencing steady growth driven by rapid urbanization, infrastructure development, and manufacturing growth. The construction industry is a significant consumer of PVC, particularly for pipes, fittings, and profiles. Additionally, the rising demand for PVC in other sectors like automotive manufacturing, electrical cables, and packaging further propels market expansion.

POLYVINYL CHLORIDE CAPACITY IN VIETNAM

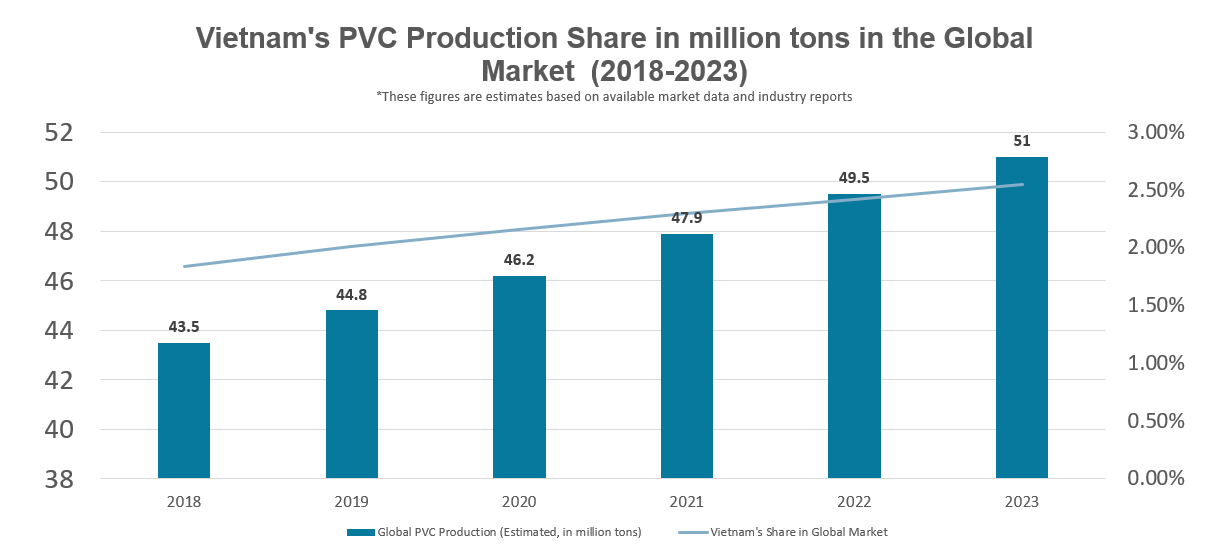

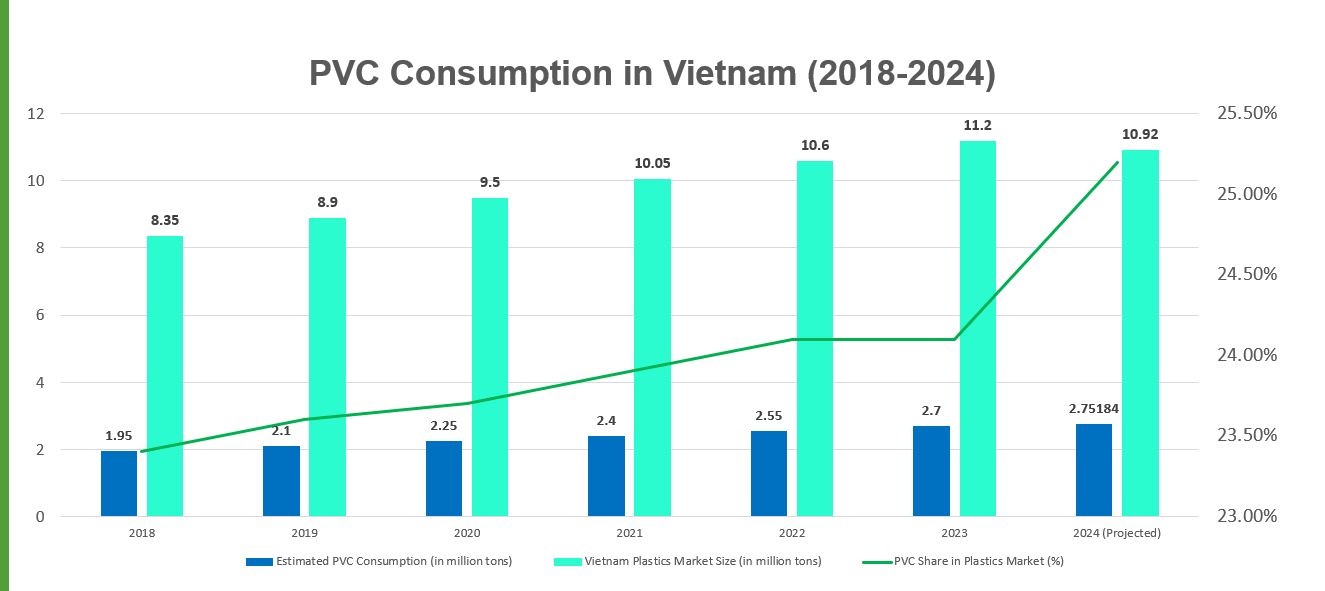

While precise data on Vietnam's 2023 PVC production capacity and its share in the global and regional markets remains elusive, the nation's burgeoning plastics industry is poised for significant growth. With a projected market size of 10.92 million tons in 2024, Vietnam is solidifying its position as a key player in the plastics arena. PVC, a major component of this market, is not only fueling industrial expansion but also playing a pivotal role in the country's economic development.

Key Factors Driving PVC Demand in Vietnam:

- Construction Boom: Rapid urbanization and infrastructure projects have fueled massive demand for PVC in pipes, fittings, profiles, and other essential building materials. This sector remains the primary driver of PVC consumption in Vietnam.

- Industrial Expansion: The growth of manufacturing industries, particularly automotive, electronics, and packaging, has significantly increased the need for PVC in various components, including wires, cables, packaging films, and interior parts.

- Rising Consumer Spending: With increasing disposable incomes, Vietnamese consumers are demanding more goods made with PVC, such as footwear, toys, and household items, further boosting PVC consumption.

These three key factors combined have created a perfect storm of demand for PVC, making it a vital material for Vietnam's continued economic development. However, this growing consumption also necessitates a focus on sustainable practices to mitigate the environmental impact of PVC production and disposal.

Consumers of Polyvinyl Chloride in Vietnam:

A. Construction Industry (Largest Consumer):

Pipes & Fittings: PVC is the material of choice for water supply, drainage, and sewage systems due to its durability, corrosion resistance, and cost-effectiveness.

Profiles: PVC profiles are widely used for windows, doors, and other building components due to their thermal insulation, soundproofing, and aesthetic appeal.

Roofing & Cladding: PVC sheets are used for roofing, wall cladding, and other exterior applications, offering protection from the elements and reducing construction costs.

Flooring & Wall Coverings: PVC flooring and wall coverings are popular choices for residential and commercial buildings due to their durability, easy maintenance, and versatility in design.

B. Automotive Industry:

Interior Components: PVC is used for dashboards, door panels, seat covers, and other interior components due to its lightweight, flexibility, and cost-effectiveness.

Wires & Cables: PVC insulation provides protection and durability to electrical wires and cables used in vehicles.

Underbody Coatings: PVC coatings protect car underbodies from corrosion and damage.

C. Packaging Industry:

Films & Sheets: PVC films and sheets are widely used for packaging various products, including food, pharmaceuticals, and consumer goods.

Bottles & Containers: PVC bottles and containers are used for packaging beverages, household chemicals, and other products.

Blister Packaging: PVC blister packs are commonly used for packaging consumer goods and pharmaceuticals.

D. Electrical Industry:

Cables & Wires: PVC is the primary insulation material for electrical cables and wires, providing excellent electrical insulation and fire resistance.

Cable Ducts & Trunking: PVC is used for cable ducts and trunking, protecting electrical wiring and ensuring safe installation.

Electrical Fittings & Accessories: PVC is used for various electrical fittings and accessories like switch boxes, junction boxes, and conduits.

E. Other Industries:

Medical Devices: PVC is used in medical tubing, bags, and other disposable medical devices due to its biocompatibility and cost-effectiveness.

Footwear: PVC is used for shoe soles, straps, and other components due to its durability, flexibility, and water resistance.

Consumer Goods: PVC is used in various consumer goods like toys, stationery, and household items.

Market Trends and Key Consumers of PVC in Vietnam:

|

Sector |

Consumption Trend |

Key Drivers |

Future Outlook |

|

Construction |

Rapid Growth |

- Urbanization and infrastructure development |

Positive |

|

Packaging |

Steady Growth |

- Rising consumer spending and e-commerce |

Stable |

|

Electrical & Electronics |

Moderate Growth |

- Industrial expansion and manufacturing growth |

Positive |

|

Automotive |

Steady Growth |

- Growing middle class and rising car ownership |

Positive |

|

Footwear |

Slow Growth |

- Competition from other materials |

Uncertain |

|

Other Industries |

Moderate Growth |

- Expansion of various sectors like agriculture, healthcare, and consumer goods |

Positive |

Future Outlook:

The demand for PVC in Vietnam is expected to remain strong in the coming years, driven by continued urbanization, infrastructure development, and industrial growth. The government's focus on affordable housing and renewable energy is likely to further boost PVC consumption. However, the industry needs to address environmental concerns and adopt sustainable practices to ensure long-term growth and acceptance.

Summary:

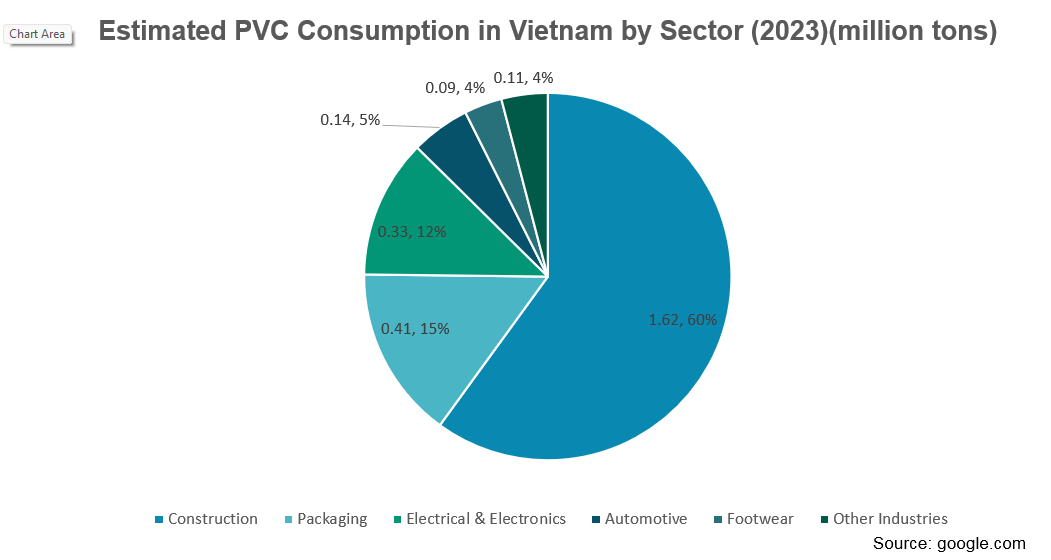

Vietnam's PVC market is booming, driven by rapid urbanization, industrial expansion, and rising consumer spending. The construction sector is the leading consumer, while packaging, electrical/electronics, and automotive sectors also contribute significantly.

PVC production in Vietnam is estimated to exceed 1 million tons annually, with major players leading the charge. Consumption is projected to reach 2.86 million tons in 2024, highlighting PVC's vital role in the nation's economy.

While challenges like raw material dependency and environmental concerns exist, the outlook for Vietnam's PVC market remains positive. Continued growth is expected, driven by infrastructure development and government support, with potential for expanding regional exports.